VA Loans and Entitlement

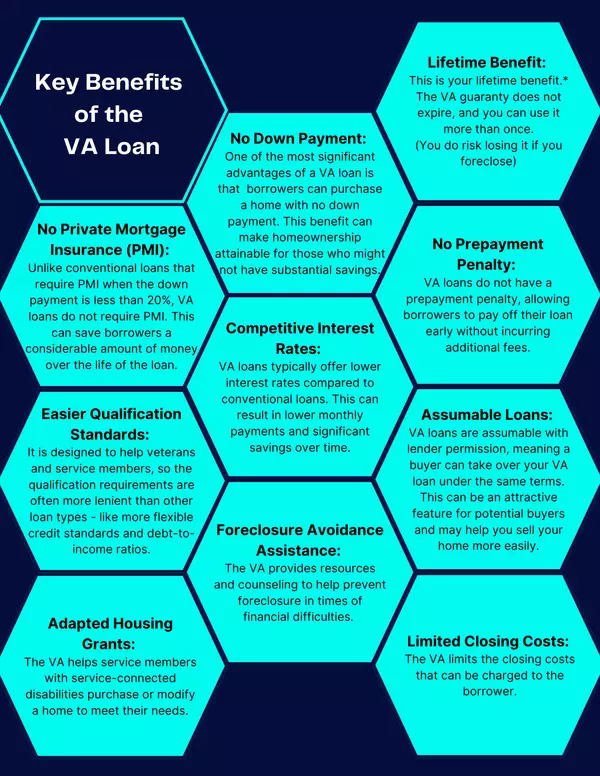

VA loans are home loans guaranteed by the Department of Veterans Affairs, which is available to active-duty service members, veterans, and some surviving spouses.

To be eligible for a VA loan, you must meet certain requirements, such as serving at least 90 days of active duty during wartime or 181 days during peacetime, and receiving an honorable discharge.

VA entitlement refers to the amount of the loan that the VA will guarantee for the borrower. "As of 2020, if you have full entitlement, you don't have a VA loan limit." (va.gov)

Eligible members can have more than one VA loan at a time, and in some cases, they can even use their VA loan benefit to purchase a second home while still owning their first. To do this, the borrower will need to have enough remaining entitlement to cover both loans. Additionally, if a borrower sells their home and pays off their VA loan, they can often reuse their entitlement to obtain another VA loan.

Overall, VA loans are a valuable benefit for eligible service members, veterans, and surviving spouses, offering competitive interest rates, low or no down payment options, and flexible credit and income requirements

Check out the va.gov website for more information:

https://www.va.gov/housing-assistance/home-loans/loan-limits/

Categories

Recent Posts