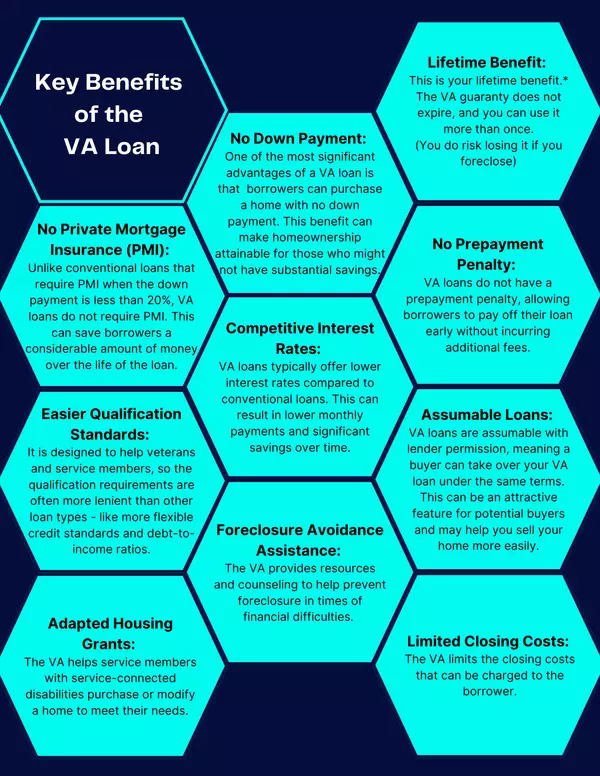

Key Benefits of the VA Loan

If you're a veteran, active-duty service member, or eligible military spouse, the VA loan program offers unique opportunities to achieve homeownership. This blog highlights the top benefits of using a VA loan, making it easier to understand why it’s one of the best tools for military families to build wealth through real estate.

1. No down payment required

One of the most appealing features of a VA loan is the ability to purchase a home with no down payment. This makes homeownership attainable for those who may not have significant savings, allowing military families to step into homeownership without waiting years to save up.

2. No private mortgage insurance

Unlike conventional loans that require PMI when the down payment is less than 20%, VA loans eliminate this extra cost. This can save borrowers thousands of dollars over the life of the loan, making it a financially savvy choice.

3. Competitive interest rates

VA loans often feature lower interest rates compared to conventional loans. This means lower monthly payments and significant savings over time, helping service members and veterans stretch their housing budgets further.

4. Easier qualification standards

The VA loan program is designed to support veterans and active-duty service members. It offers more lenient qualification requirements, such as flexible credit standards and higher debt-to-income ratios, making it easier to secure financing.

5. Lifetime benefit

Your VA loan entitlement is a lifetime benefit. The VA guaranty doesn’t expire, and you can use it more than once. However, keep in mind that foreclosure could lead to losing this benefit.

6. No prepayment penalty

VA loans allow borrowers to pay off their loans early without any prepayment penalties. This flexibility lets you save on interest if you decide to pay off your mortgage ahead of schedule.

7. Foreclosure avoidance assistance

The VA provides resources and counseling to help veterans and service members avoid foreclosure during times of financial hardship. This safety net can provide peace of mind when challenges arise.

8. Adapted housing grants

For veterans with service-connected disabilities, the VA offers grants to purchase or modify homes to better meet their needs. This support helps make homes accessible and functional for disabled service members.

9. Assumable loans

VA loans are assumable with lender permission, meaning a buyer can take over your loan under the same terms. This can be a valuable selling point when you’re ready to move, especially in high-interest rate markets.

10. Limited closing costs

The VA sets limits on the closing costs that can be charged to borrowers, reducing out-of-pocket expenses when purchasing a home.

Why the VA loan is a game-changer

The VA loan program is more than just a financial tool—it’s a way to make homeownership accessible and affordable for those who have served our country. From no down payment and lower interest rates to foreclosure support and lifelong benefits, this program ensures military families have the support they need to achieve their real estate goals.

Whether you’re purchasing your first home, upgrading to meet your family’s needs, or investing for the future, the VA loan can help you build financial security and stability.

If you’re ready to explore how the VA loan can work for you, let's get connected!

Categories

Recent Posts