To Rent or To Buy?

As a real estate professional, I want my clients to be paying for their own mortgage over someone else's mortgage, but it is not always a possibility. If your financal situation allows for you to buy a home and it makes sense to do so then you should build your wealth by investing in your future. However, if your circumstances are not allowing you to be able to buy right now, then lets make the right moves together to prepare you to buy in the future.

If you're considering whether to rent or buy a home, there are a few factors to consider. This guide will help you determine which option is best for you:

-

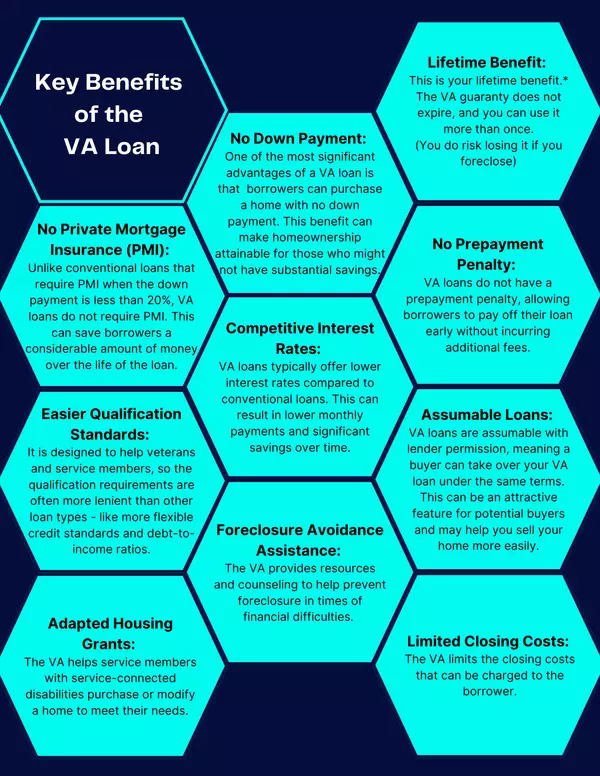

Evaluate your finances. Buying a home typically requires a significant amount of upfront money, including a down payment, closing costs, and other fees. Calculate how much you can afford to spend each month on mortgage payments, property taxes, and maintenance costs. Compare these costs to the cost of renting in your area. Consult with a lender to determine your options and whether you can secure financing.

-

Consider your long-term plans. If you plan to stay in the same location for several years, buying a home may be a good option. You will build equity in your home, which can help you financially in the future. However, if you plan to move frequently, renting may be a better option. If you are interested in building passive income funnels, buying and then renting out your home when you move is an option to consider.

-

Determine the local real estate market. If the local real estate market is hot and homes are selling quickly, buying a home may be a good option. However, if the market is slow and homes are scarce, renting may be a better option.

-

Think about your lifestyle. If you value flexibility and want the ability to move easily, renting may be a better option. If you want the freedom to make changes to your home and yard, buying may be a better option.

-

Consider your employment situation. If you have a stable job and don't anticipate any major changes in your income or employment, buying a home may be a good option. However, if your job situation is uncertain or you anticipate a significant change in your income, renting may be a better option.

-

Think about your overall financial goals. If you have other financial goals, such as paying off debt or saving for retirement, consider how buying a home will impact those goals. Buying a home is a big financial commitment and may impact your ability to achieve other financial goals.

-

Seek advice from a real estate professional. A real estate professional can help you evaluate the local real estate market, calculate the costs of buying vs. renting, and provide valuable insights into the decision-making process.

By weighing these factors carefully, you can make the best decision for you and your family.

Categories

Recent Posts