How to Build Wealth Using Your VA Entitlement and BAH

Military members!

On top of your monthly pay you get Basic Allowance for Housing (BAH). The amount of BAH you receive is dependent on your duty station, your pay grade, and whether you have dependents or not. To calculate your BAH, visit this link:

Housing options for military members include living on base, renting off base, or buying off base. If you and your family live on base, the company in charge of base housing receives all of your BAH. If you choose to rent off base, you are helping your landlord pay for their mortgage. There are circumstances under which these options are the best options, but if you are able to purchase your own home you could set your family up for financial success through the purchase of several properties throughout your military career.

You can use your BAH as an investment tool to build wealth during your military career. Here is an example of building wealth using your VA Entitlement and BAH:

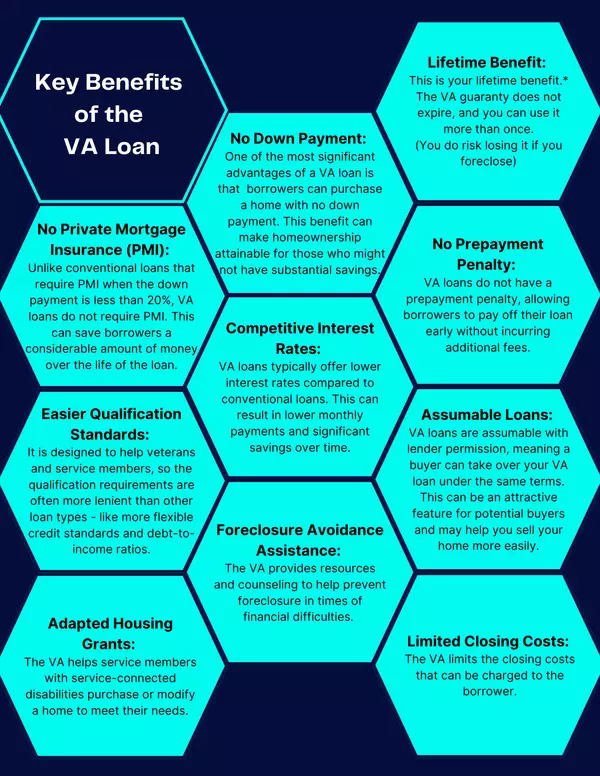

Duty Station #1: Purchase a home with 0 money down with your VA loan. Purchase a home that meets your minimum house needs and is under your max budget. You may consider purchasing a home that needs a little work and build sweat equity through minor upgrades while you live there. When you leave Duty Station #1, rent out this home.

Duty Station #2: You will rent out the home from Duty Station #1 and you will likely still have remaining VA Entitlement. You will utilize a VA loan again to purchase a second home with 0 money down. This home may be a little more of what you want and need for your family. You are likely seeing some profit over the rent you are gaining from your first home. You will focus on building your savings. You will also rent out this home when you leave Duty Station #2.

Duty Station #3: You may have some remaining VA entitlement, but likely not much for a complete home purchase. You have two options. First option is refinancing a previous home purchase and utilize the VA's ONE TIME RESTORATION option. This will restore your VA entitlement from the purchase of that home and allow you to use it again for your third home purchase. This will allow you to purchase again with 0 money down. Your second option is to use a different loan structure. This will likely mean that you have to bring money for a down payment, but by now you might have the savings to do so.

And the pattern continues as your finances allow you to purchase homes. The goal is to realize profit from your rentals, grow your savings, and increase the number of properties you own throughout your military career. By the end of your military career you may have 3-8 homes that are generating income and building equity. You could retire, sell these homes, and put the profits towards your dream home or a retirement account.

There are many factors to consider when making any of the decisions outlined in this article. Make sure you consult your real estate professional who can help you weigh your options. Like any investment, investing in real estate comes with risks and rewards.

Categories

Recent Posts