First Time Homebuyer - FAQ

Buying your first home can be an exciting and overwhelming experience. It’s likely the largest purchase you’ll ever make, and it’s important to know what you’re getting into. In this blog post, I’ll answer some frequently asked questions about buying your first home.

- How much money do I need to buy a house?

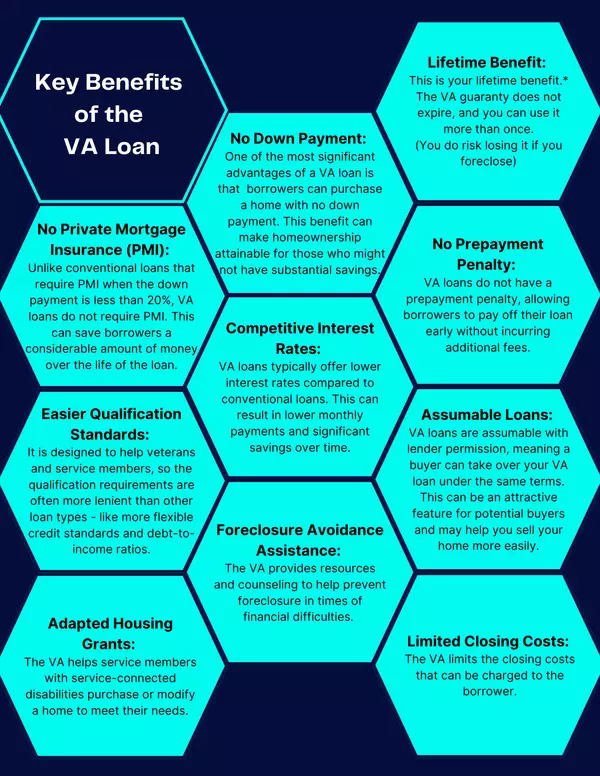

The amount of money you need to buy a house depends on several factors, including the purchase price of the home, your down payment, closing costs, and any additional fees. A good rule of thumb is to have at least 20% of the home’s purchase price as a down payment, but some loan programs allow for a lower down payment. A VA loan requires no money down, and an FHA loan requires 3.5% down.Your lender can also educate you on available first time home buyer programs which allow for no money down. You’ll also need to budget for costs that occur during the transaction such as earnest money, inspections, and the appraisal. Closing costs, which can range from 2% to 5% of the purchase price, are also included on your closing disclosure.

- What type of mortgage should I get?

There are several types of mortgages available, including fixed-rate, adjustable-rate, and government-backed loans. Fixed-rate mortgages offer a stable interest rate for the life of the loan, while adjustable-rate mortgages have a variable interest rate that can change over time. Government-backed loans, such as FHA or VA loans, have different requirements and benefits than conventional loans. It’s important to speak with a lender to determine which type of mortgage is best for your situation.

- How do I find a good real estate agent?

A good real estate agent can help guide you through the homebuying process and answer any questions you have. Ask friends and family for recommendations, or research agents online. Look for agents who have experience in your desired location and who are knowledgeable about the type of home you’re interested in.

- How do I know if a home is in good condition?

Before making an offer on a home, it’s important to have it inspected by a professional home inspector. The inspector will examine the home’s structure, electrical systems, plumbing, and more to ensure that it’s in good condition. If any issues are found, you can negotiate with the seller to have them repaired or ask for a credit to cover the cost of the repairs. Certain types of inspections are required in Florida for loan type or home owners insurance purposes.

- What are closing costs?

Closing costs are fees associated with the purchase of a home that are paid at closing. These can include fees for the loan, appraisal, title search, and more. Closing costs typically range from 2% to 5% of the purchase price of the home.

- How much should I offer for a home?

The amount you should offer for a home depends on several factors, including the home’s condition, location, and market demand. Your real estate agent can help you determine a fair offer based on comparable homes in the area.

- What happens after my offer is accepted?

Once your offer is accepted, you’ll enter into a contract with the seller. You’ll need to provide earnest money, which is a deposit to show that you’re serious about purchasing the home. Your lender will also begin the process of underwriting your loan, which includes verifying your income and creditworthiness. Your agent will help you coordinate home inspections and the home appraisal, as well as do much behind the scenes to get the transaction moving towards closing.

Buying your first home can be overwhelming, but by doing your research and working with a team of professionals, you can make the process as smooth as possible. If you have any additional questions, be sure to speak with your lender or real estate agent for guidance.

Categories

Recent Posts